Cash Flow Forecasting Tool | See Your Next 12 Months Clearly

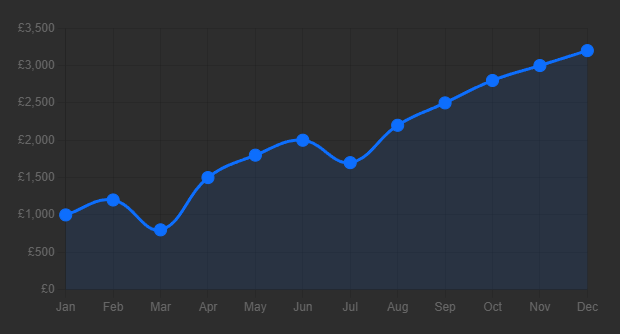

CashFlowPal is a simple cash flow forecasting tool that shows small businesses exactly where their money will be over the next 12 months.

Unlike accounting software that only looks backwards, or Excel spreadsheets that break every month, CashFlowPal gives you a rolling forecast that’s always 12 months ahead.

Set up in minutes, forecast with confidence, and make business decisions knowing exactly what impact they’ll have on your cash position.

Built-in corporation tax calculator means no surprises. Perfect for business owners and accountants who need clarity, not complexity. £29 per month.

Stop Guessing. Start Knowing Where Your Cash Will Be.

CashFlowPal is a cash flow forecasting tool

That shows you exactly where your money will be for the next 12 months.

No complicated setup. No accounting jargon. Just clear, rolling forecasts that help you make confident business decisions.

Whether you’re planning to hire staff, invest in equipment, or simply want to sleep better at night knowing your tax bill is covered, CashFlowPal gives you the visibility you need to run your business with certainty, not crossed fingers.

Simple forecasting. Powerful decisions. £29 per month.

Why CashFlowPal Beats the Alternatives

The Problem with How You’re Managing Cash Flow Now

Most businesses try to forecast cash flow using tools that weren’t designed for it—and it shows.

Accounting software like Zoho tells you where you’ve been, not where you’re going. It’s brilliant for recording history but hopeless at predicting the future. You can see last month’s profit, but you can’t see if you’ll have enough cash to pay your tax bill in six months.

Excel spreadsheets start with good intentions but quickly become a monthly nightmare. Every time you move forward a month, you’re copying, pasting, and updating formulas. One mistake breaks the whole thing. Version control becomes chaos. And nobody wants to touch it because it’s held together with digital sticky tape.

Guesswork works until it doesn’t—usually at the worst possible moment when you need certainty most.

How CashFlowPal Solves This

CashFlowPal is a dedicated cash flow forecasting tool built for one purpose: showing you the next 12 months of your cash position with clarity and confidence.

Always 12 months ahead: Your forecast rolls forward automatically. As each month passes, CashFlowPal extends your view, so you’re always looking a full year into the future.

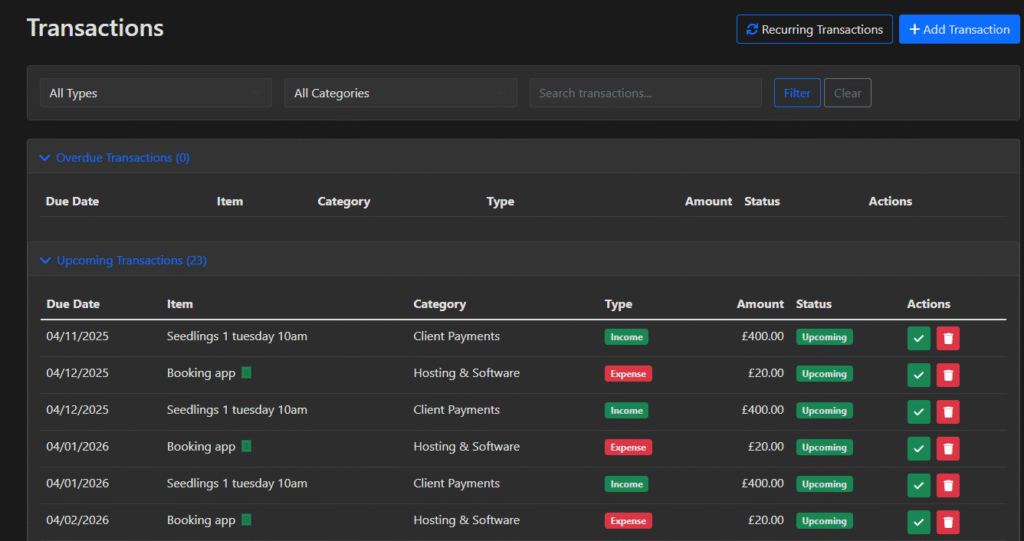

No formulas to break: Set your recurring income and expenses once. CashFlowPal handles the rest. No monthly copying and pasting. No broken formulas. No version control headaches.

Corporation tax calculator included: CashFlowPal works out your corporation tax liability based on your forecast, so you know exactly when bills are due and how much they’ll be. No surprises.

Set up in minutes: Add your starting balance, plug in your regular income and expenses, and you’re done. No integration headaches. No technical knowledge required.

Features That Make Business Decisions Easier

Everything You Need to Forecast with Confidence

Rolling 12-Month Forecast See your cash position for every month over the next year. Plan investments, hiring decisions, and major purchases knowing exactly what impact they’ll have.

Recurring Income and Expenses Set transactions to repeat monthly, quarterly, or annually. CashFlowPal automatically includes them in your forecast without manual updates.

Scenario Planning Play with “what if” situations before committing. What happens if you hire someone in March? Buy new equipment in June? Lose a major customer? See the impact instantly without affecting your main forecast.

Built-In Tax Calculator CashFlowPal calculates your corporation tax liability based on your projected profits, so you can plan for payment dates without nasty surprises.

Team Access Share your forecast with business partners, accountants, or financial advisors. Everyone sees the same picture, making collaboration simple.

Mobile Friendly Check your cash position from your phone or tablet. Make informed decisions wherever you are, without needing to be at your desk.

Quick Setup Be up and running in under 10 minutes. No complicated integrations. No endless configuration. Just straightforward forecasting.

Perfect for Small Businesses and Their Accountants

Business owners use CashFlowPal to answer critical questions: “Can I afford to hire next quarter?” “Should I invest now or wait?” “Will summer revenue cover winter costs?”

Accountants use CashFlowPal to help clients see the impact of decisions before they make them, positioning themselves as strategic advisors rather than just compliance services.

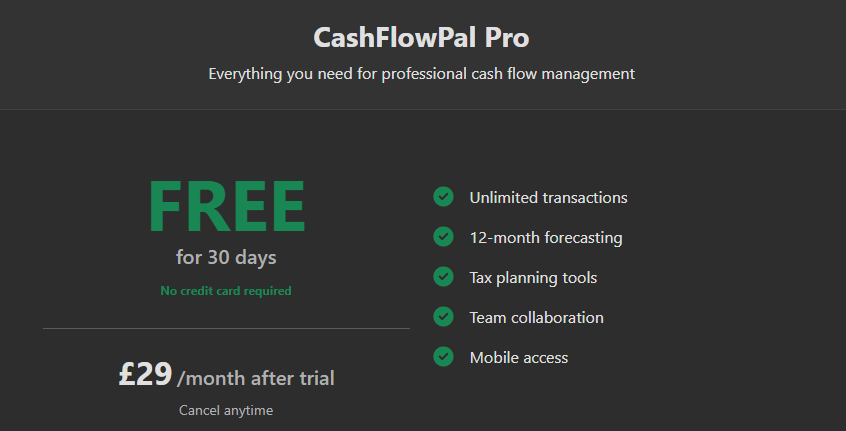

Simple Pricing, Powerful Results

£29 Per Month. Cancel Anytime.

One simple price includes everything:

- Rolling 12-month cash flow forecast

- Unlimited scenarios

- Corporation tax calculator

- Team access for partners and advisors

- Mobile-friendly access

- Setup in under 10 minutes

No contracts. No hidden fees. No surprises.

CashFlowPal is a standalone cash flow forecasting tool that works for any business, any size, any sector. Whether you’re running a leisure venue with seasonal income, a growing business planning to scale, or simply want to make decisions based on facts rather than guesswork, CashFlowPal gives you the clarity you need.

Stop flying blind. See exactly where your cash will be for the next 12 months.

Frequently Asked Questions

What is CashFlowPal and how does it help leisure operators?

CashFlowPal is a standalone cash flow forecasting tool designed for small businesses that helps predict upcoming income and expenditure patterns, preventing financial surprises by providing visibility of future cash positions weeks or months in advance. Unlike traditional accounting software that shows what happened in the past, CashFlowPal shows what’s likely to happen in the future, allowing businesses to anticipate cash shortfalls before they become critical problems requiring emergency funding or service cuts. While CashFlowPal works for any small business, it’s particularly valuable for leisure operators facing unique seasonal challenges and irregular funding patterns.

Leisure operations face distinctive cash flow challenges, including seasonal membership patterns, unpredictable casual usage, delayed local authority payments, and irregular grant funding cycles. Swimming pools experience peak membership in January and summer holidays but face quiet periods in autumn when cash inflow drops significantly whilst fixed costs like heating, staffing, and maintenance remain constant. CashFlowPal helps operators model these patterns by forecasting income from memberships, casual visits, classes, and facility hire alongside regular expenditure like payroll, utilities, maintenance contracts, and loan repayments, creating visibility of when cash positions become tight and when surplus cash becomes available for investment or debt reduction.

The forecasting tool allows scenario planning essential for strategic decision-making. Should you run a January membership promotion, or will the resulting cash inflow merely create a bigger cash deficit in February when members stop using the facilities? Can you afford to replace ageing gym equipment in March, or should you wait until summer when casual swimming income improves your cash position? Should you negotiate extended payment terms with suppliers to smooth cash flow during quiet periods? CashFlowPal helps answer these questions by modelling different scenarios and showing their impact on future cash positions, transforming financial planning from reactive firefighting into proactive strategic management.

For charitable leisure trusts and council-operated facilities operating on tight margins with limited financial reserves, cash flow visibility becomes critical for survival. A single unexpected maintenance cost combined with delayed grant payment can create a crisis requiring emergency overdrafts, deferred supplier payments, or even temporary facility closures. CashFlowPal’s advance warning allows operators to secure bridging finance early, renegotiate payment terms proactively, or adjust operational expenditure before cash positions become critical, maintaining service continuity whilst protecting the organisation’s financial stability and reputation with funders, lenders, and local

How does cash flow forecasting prevent financial surprises?

Cash flow forecasting prevents financial surprises by showing you future income and expenditure patterns weeks or months in advance, allowing you to spot potential cash shortfalls before they happen and take corrective action whilst you still have time to respond. Unlike waiting for your bank balance to drop dangerously low or discovering you can’t pay suppliers when invoices become due, forecasting gives you early warning that cash positions will become tight, enabling you to secure additional funding, renegotiate payment terms, or reduce discretionary spending before a problem becomes a crisis.

Small businesses commonly experience profitable months where sales exceed costs but still face cash flow problems because income arrives later than expenses need paying. A leisure centre might have excellent membership sales in January, but if members pay by direct debit collected mid-month while staff wages, utility bills, and supplier invoices are due at the start of the month, the business faces a cash shortage despite being financially healthy. CashFlowPal’s forecasting reveals these timing mismatches, showing that although you’ll be profitable over the month, you need bridging finance for the first two weeks or need to negotiate later payment dates with suppliers to match when your income actually arrives in the bank account.

Seasonal businesses, whose revenue patterns fluctuate dramatically throughout the year and many costs remain fixed, face particularly acute forecasting needs. Swimming pools generate strong income during summer holidays and January fitness campaigns but experience quiet periods in autumn and spring when casual usage drops significantly. Without forecasting, operators might assume summer’s healthy bank balance means they can afford new equipment or facility improvements, only to discover in October that autumn’s reduced income leaves them struggling to cover heating bills and staffing costs. Cash flow forecasting prevents these surprises by modelling seasonal patterns that show when surplus cash can genuinely be spent and when reserves need protection to cover upcoming lean periods.

Irregular or delayed payments from customers, local authorities, or grant funding bodies create additional uncertainty that forecasting helps manage. If your leisure trust relies on quarterly grant payments from the council but previous payments arrived 2-4 weeks late, CashFlowPal allows you to model scenarios where this quarter’s payment is also delayed, showing whether your reserves can cover the gap or whether you need to arrange temporary credit facilities before the shortfall occurs. This proactive approach transforms unpredictable external factors from potential crises into managed risks with contingency plans already in place.

Can CashFlowPal integrate with our existing finance software?

CashFlowPal is designed as a standalone forecasting tool that works independently of your existing accounting or finance software, allowing you to use it regardless of whether you use Xero, QuickBooks, Sage, FreeAgent, or any other bookkeeping system. Rather than requiring complex integrations or data synchronisation, CashFlowPal allows you to manually input your forecasted income and expenditure patterns based on your business knowledge and historical data from your existing systems, giving you complete control over the forecasting assumptions without being constrained by how your accounting software categorises transactions.

The standalone approach offers significant advantages for small businesses where finance software integration can be expensive, technically complex, and require ongoing maintenance as systems update. Many small leisure operators, independent gyms, community sports clubs, and similar businesses find that their accountant manages their bookkeeping software remotely, making direct system integration impractical. CashFlowPal’s manual input model means you can forecast cash flow without needing technical access to your accounting system, IT support for integration setup, or concerns about data security when connecting multiple financial systems.

Manual forecasting also encourages better financial planning by requiring you to actively think about upcoming income and expenses rather than passively accepting historical patterns that accounting software automatically projects. When you manually input that January typically generates £45,000 in membership income but February drops to £28,000, you’re consciously acknowledging the seasonal pattern and planning for it. When you input an expected £8,000 maintenance bill in March, you’re actively planning for that expenditure rather than being surprised when it appears in your accounting software after the money has already left your bank account.

For businesses that want to leverage data from their existing finance software, CashFlowPal accepts manual data entry based on reports you export from your accounting system. You can review your historical income and expenditure patterns in Xero, QuickBooks, or Sage, then use those patterns to inform your CashFlowPal forecasts, adjusting for known upcoming changes like planned facility improvements, new service launches, or expected grant funding. This approach gives you the benefit of historical data without the complexity and cost of system integration, whilst allowing you to override historical patterns when your business knowledge suggests future performance will differ from past results.

Why should any business use CashFlowPal?

Any business should use CashFlowPal because cash flow problems are the leading cause of small business failure, and forecasting future cash positions prevents the common trap of being profitable on paper whilst running out of money to pay suppliers, staff, or rent. Unlike accounting software that shows historical performance, CashFlowPal shows what’s coming next, allowing you to spot potential shortfalls weeks or months in advance and take corrective action whilst you still have options, rather than discovering problems when creditors are demanding payment and your bank account is empty.

Small businesses across all sectors experience the disconnect between profitability and cash flow. You might have £100,000 in confirmed orders or sales, but if customers pay 30-60 days after delivery whilst you need to pay suppliers, staff wages, and rent immediately, you face a cash shortage despite being commercially successful. CashFlowPal helps you model these timing mismatches, showing when the gap between expenditure due and income arriving creates cash flow pressure, allowing you to arrange bridging finance, negotiate extended payment terms with suppliers, or accelerate customer payments through early settlement discounts before the shortfall becomes critical.

Seasonal businesses particularly benefit from cash flow forecasting because revenue fluctuates dramatically throughout the year whilst many costs remain fixed. Retail businesses experience Christmas peaks followed by January troughs, tourism operators see summer surges and winter quiet periods, and leisure centres face membership spikes in January with autumn declines. Without forecasting, these businesses might spend summer’s surplus on improvements or expansion, only to discover in autumn that reduced income leaves them unable to cover heating, staffing, and maintenance costs. CashFlowPal’s seasonal modelling shows when surplus cash can genuinely be spent and when reserves need protecting for upcoming lean periods.

Growing businesses face hidden cash flow challenges that forecasting reveals before they become obstacles to expansion. Hiring additional staff, opening new locations, or launching new products all require upfront investment before generating returns, creating temporary cash flow pressure even when the business case is sound. CashFlowPal allows you to model growth scenarios, showing whether your existing cash reserves and projected income can sustain the investment period or whether you need to secure additional funding before committing to expansion. This forward visibility transforms growth from a risky leap into a planned, funded development with contingencies in place for scenarios where income takes longer to materialise than expected.

The affordability and simplicity of CashFlowPal make it accessible to small businesses that find enterprise financial planning software too expensive or complex. You don’t need accounting expertise, technical integrations, or financial modelling skills to benefit from cash flow forecasting—just the willingness to think about upcoming income and expenses and update your forecast regularly based on how business is actually performing. This democratisation of financial forecasting helps small businesses achieve the visibility and control that larger companies gain from expensive finance teams and sophisticated planning systems, reducing the financial risk that causes so many promising businesses to fail despite having viable products, services, and markets.

What is CashFlowPal and why should you use it?

CashFlowPal is a standalone cash flow forecasting tool designed for small businesses that shows your predicted bank balance weeks or months into the future, helping you spot potential cash shortfalls before they happen and take corrective action whilst you still have options. Unlike accounting software that tells you what happened in the past (last month’s profit, last quarter’s expenses), CashFlowPal tells you what’s coming next, transforming financial management from reactive firefighting into proactive planning where you can see problems approaching and respond before they become crises.

You should use CashFlowPal because cash flow problems cause more small business failures than lack of sales or unprofitable operations, and most businesses discover cash shortages too late to avoid serious consequences like bounced payments, damaged supplier relationships, or emergency high-interest borrowing. Many profitable businesses fail because they don’t realise they’re running out of cash until creditors are demanding payment and the bank account is empty. CashFlowPal’s forward visibility gives you the early warning needed to arrange bridging finance, negotiate extended payment terms, or reduce discretionary spending before shortfalls become critical, protecting your business from the cash flow crises that destroy otherwise viable companies.

Small businesses particularly benefit from CashFlowPal because they lack the financial teams and sophisticated planning systems that larger companies use to maintain cash flow visibility. Enterprise businesses employ finance directors, management accountants, and treasury specialists to monitor and forecast cash positions, giving them months of advance warning about potential problems. Small businesses typically rely on their accountant’s monthly retrospective reports or simply monitor their bank balance, discovering problems only when it’s too late to implement anything except emergency measures. CashFlowPal democratises financial forecasting, giving small businesses the same forward visibility that larger companies achieve through expensive finance departments and complex planning software.

The tool works through simple manual input where you forecast your expected income and expenditure based on your business knowledge and historical patterns, rather than requiring complex integrations with accounting systems or technical expertise. You input that you expect £15,000 in membership income next month, £8,000 in wages, £3,000 in utilities, and £5,000 in supplier payments, and CashFlowPal shows you what your bank balance will be. As weeks progress, you update the forecast based on actual performance—if membership income came in at £13,000 instead of £15,000, you adjust future forecasts accordingly and see immediately whether this shortfall creates problems in upcoming weeks. This regular updating ensures your forecast remains accurate and actionable rather than becoming a static document that bears no relation to reality.

CashFlowPal is particularly valuable for seasonal businesses, growing businesses, and businesses with irregular income or payment patterns. If you experience quiet periods and busy seasons, CashFlowPal shows whether summer’s surplus can cover winter’s shortfall or whether you need to maintain larger reserves. If you’re planning expansion, it models whether your cash reserves can sustain the investment period before new revenue arrives. If major customers pay 60 days after invoicing whilst suppliers expect payment within 30 days, it reveals the timing mismatches that create cash flow pressure despite profitable operations. The insight transforms uncertain financial situations into planned scenarios with contingencies in place, giving you confidence that your business can survive the challenges ahead rather than hoping you’ll somehow muddle through without running out of money.

Book a Call With Our Team

We’re on hand for any questions you may have. Simply book a meeting using our booking system and we will talk you through any questions.